Q: I heard there is a new Form W-4. Why did they change the form (it seems it was the same for many years) and what do we need to know about it?

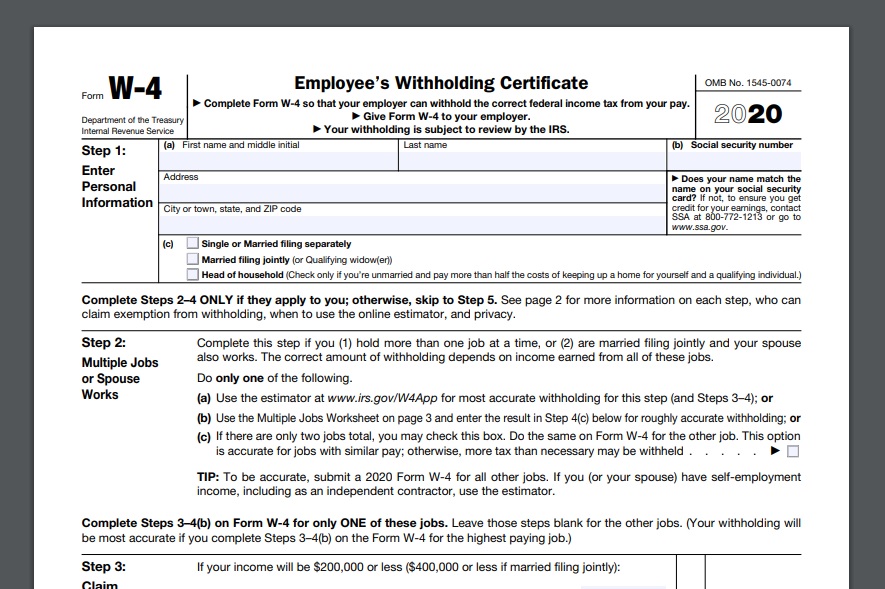

A: Yes, the IRS redesigned Form W-4 –the one we all complete our first day at work that tells the employer “how to figure your tax withholding”. It takes effect January 1, 2020 and according to IRS Commissioner Charles Rettig “the primary goal of the new design is to provide simplicity, accuracy and privacy for employees while minimizing burden for employers and payroll processors.” “While it uses the same underlying information as the old design, it replaces complicated worksheets with more straightforward questions that make accurate withholding easier for employees.” The following info is paraphrased from the IRS.gov website.

What’s different?

The redesigned form is broken down into 5 Steps, however the overall look is very similar. One thing that’s missing, is the familiar “Withholding allowances” section which has been replaced (sort of) by Step 3 which provides a place to enter number of dependents.

Most people will just need to complete Step 1 (chose Married, Single, Married filing jointly) and Step 5, which is to sign and date. By doing only these two steps, your withholding will be computed based on your filing status’ standard deduction and tax rates, with no other adjustments.

Steps 2, 3 and 4 are optional and apply if you have multiple jobs, dependents or other potential tax credits and liabilities.

The new form is supposed to make it easier for you to have your withholding match your tax liability. Meaning you won’t owe unexpected taxes or have a large refund. Obviously the more info you give them, the more precise your withholding.

Does everyone need to complete a new form?

No. Only employees hired after January 1, 2020 are required to use the new form. However anyone hired prior to that who wishes to update to a new form, can do so if they wish.

Employers should continue to compute payroll withholding based on the information from the employee’s most recently furnished Form W-4 (whether it’s the 2020 revised form or from the old form).

What if I want a refund when I file my tax return. How should I complete the new form?

If you prefer to have more tax than necessary withheld from each paycheck, you will get that money back as a refund when you file your tax return (keep in mind though you do not earn interest on the amount you overpay). The simplest way to do this is to enter in Step 4(c) the additional amount you would like your employer to withhold from each paycheck.

In short, give new hires the new form, and check out all the tools available at the IRS.gov website.

Source: irs.gov/newsroom/faqs-on-the-2020-form-w-4

©Copyright Eva Del Rio

Eva Del Rio is creator of HR Box™ – tools for small businesses and startups. Send questions to Eva@evadelrio.com