Q: We are a small company of about 30 employees. We have a small gift shop for customers on the premises and extend up to $100 credit for employees and ask they pay it in full at the end of each month. The problem is sometimes employees leave before their accounts are paid. We’ve gotten burnt in the past by unpaid balances but have been reluctant to dock their last paycheck because it might be illegal. Is it illegal to dock pay?

A: First, you should be reluctant to dock someone’s pay. Not only can you make someone very mad by messing with their paycheck in a way they don’t expect, but there are also laws that protect wages and require employers to abide by certain rules. So, caution is this area is well advised.

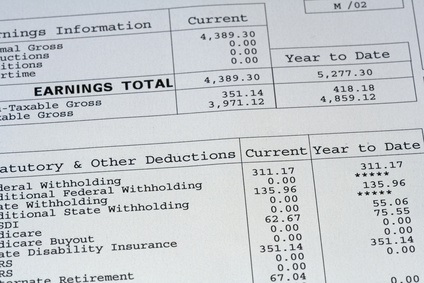

Having said that, docking pay is not illegal if done correctly. When an employee terminates employment -voluntarily or involuntarily- and doesn’t return company property like a cell phone/laptop; or when an employee has made unauthorized credit card purchases; or when (as in your case) the employee simply owes you money, the employer is allowed to deduct the cost of what is owed the company as long as they meet a minimum wage criteria with the final paycheck. What does that mean?

It means you are able to deduct the cost as long as the remaining amount is at least the equivalent of hours worked at minimum wage. For example, if during the last week the employee worked 40 hours at their normal pay rate of $15/hr, their normal check would have been $600. So, you could easily deduct $100 and still pay them $500, (or $12.50/hr) which is well above the $8.10 minimum wage in Florida, keeping you in compliance of the law.

Of course, docking someone’s pay should be done as a last resort, after friendly attempts at payment have been tried. But sometimes departing employees are uncooperative, or disappear, or quit unexpectedly.

I DO suggest you add something to your handbook to address what happens when this perk is not paid back. Keep it simple:

“Upon end of employment, any unpaid balance will be deducted from the last paycheck.” should suffice.

It’s not necessary for the handbook to go into technicalities about the minimum wage. What’s important is that the employee not be surprised if their last paycheck is short. An explanation on the final pay stub, or a personal note can go a long way to avoid hard feelings.

Not intended as legal advice.

Related column Holding that last paycheck? think again

©Copyright Eva Del Rio

Eva Del Rio is creator of HR Box™ – tools for small businesses and startups. Send questions to Eva@evadelrio.com